Consumer Confidence Dips Amid Political Unrest and Economic Uncertainty: ThinkNow Pulse 2018 Report Released

Despite steady income and low unemployment, consumers still leery of economy’s growth potential

“A country divided” doesn’t just define the current political climate in the U.S. today, but also speaks to consumers' general outlook of the economy and its impact on their way of life, including their purchase decisions. In the 5th installment of our annual report, ThinkNow Pulse™, we delved into consumer sentiment across Hispanic, African-American, Asian, and non-Hispanic white cohorts and found stark contrasts in consumer expectations last year when compared to past years. The study also reveals an employed consumer base with access to steady income.

This new report, now available for download, features three-years of trending data to give brands and companies an unprecedented look at how economic sentiment across multicultural populations has changed over time. So, let’s look at three key areas of the report: income, employment, and general outlook.

Income

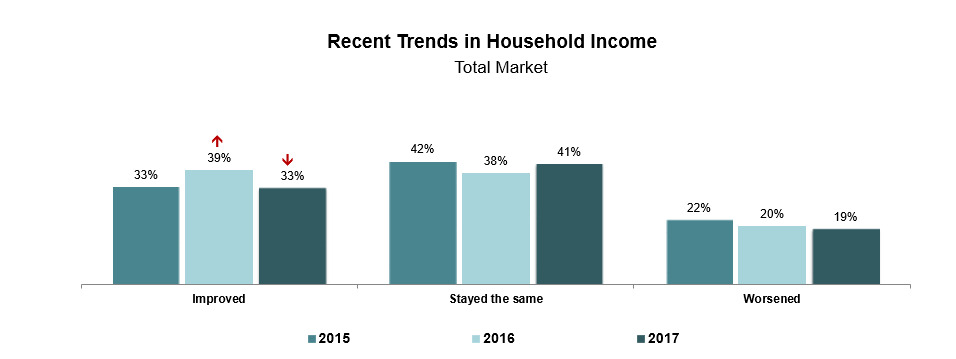

When consumers have more disposal income, it’s fair to say that they spend it with brands they love. But in 2017, most Americans reported that their household income, including all sources of income, stayed the same in 2017 when compared to this same time last year. This followed a significant improvement in 2016.

This finding is consistent with the American Community Survey data that shows a similar trend of median household income. While it is tempting to view stagnation in wages as detrimental to companies’ bottom lines, keep in mind that 2016 represented a large bump in median household incomes, a record increase in fact. So, maintaining that same level of income after a record increase the previous year is positive. We may even see these numbers improve this year with the passing of tax reform.

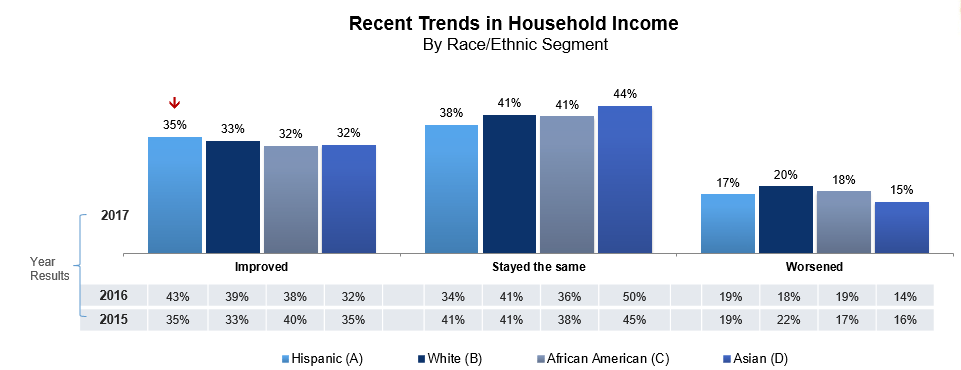

If we drill down to major ethnic segments, we see that Hispanics were the most likely to report higher incomes in 2017. But there is a slight caveat here as only 35% of Hispanics stated that their income improved in 2017 vs. 43% in 2016, representing a slight decrease:

The fact remains that Hispanic income is steadily improving which implies greater access to spendable funds, boding well for brands and companies looking to begin or expand their Hispanic marketing efforts in 2018.

Employment

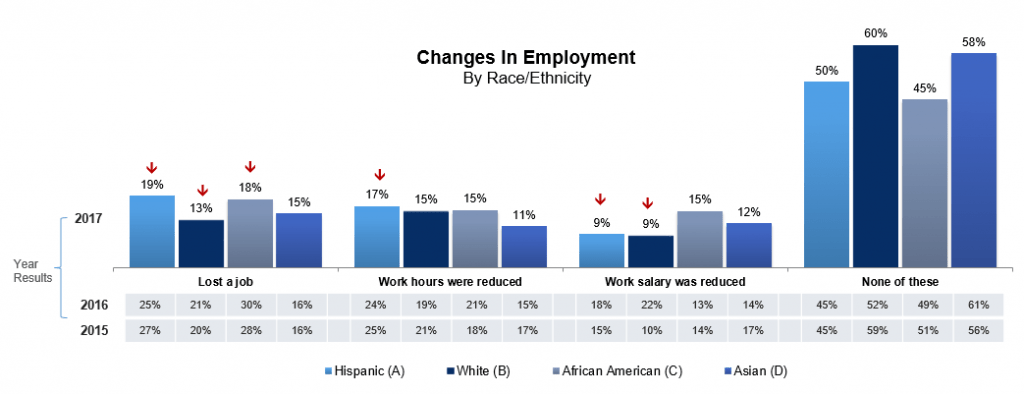

Like last year, only about 2 in 10 consumers said that their financial situation worsened due to employment status. In fact, employment numbers were better in 2017 across the four major race/ethnic segments. Among those, Hispanics and African-Americans saw the largest drop in unemployment status from 2015 – 2017, a drop of 8% and 12% respectively.

Our data mirrors the most recent employment data released by the Bureau of Labor Statistics and again, bodes well for companies and brands. Steady income and high employment stimulate consumer spending. We saw evidence of this during the record-breaking 2017 holiday retail shopping season that exceeded the National Retail Federation’s forecasts by 5.5%

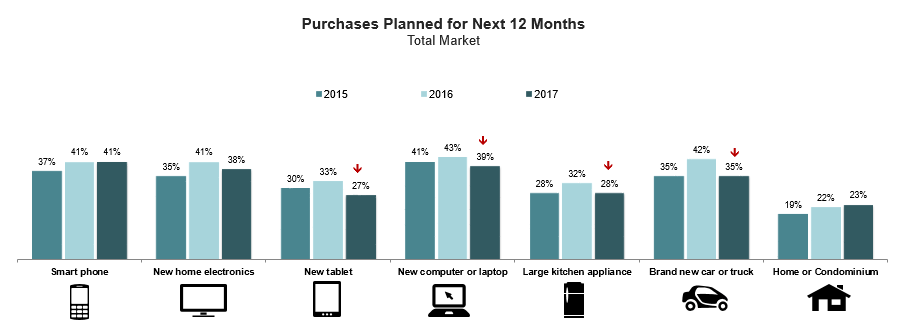

While we’ll see this spending level out as we get further into 2018, some purchases, like home buying levels, are relatively unchanged for the past two years:

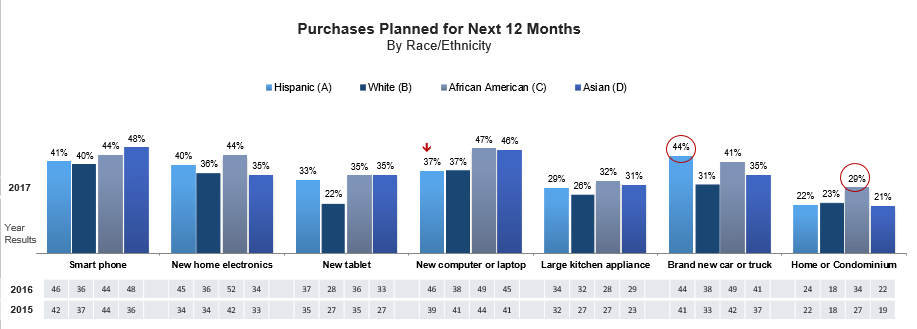

Diving deeper into purchases across ethnicities, Hispanic consumers are a particular bright spot for the automotive industry as they are the most likely to purchase a vehicle in 2018 and African-Americans are a bright spot for the real estate industry (and any home goods related industries) as they are the most likely to buy a home in 2018:

Economic Outlook

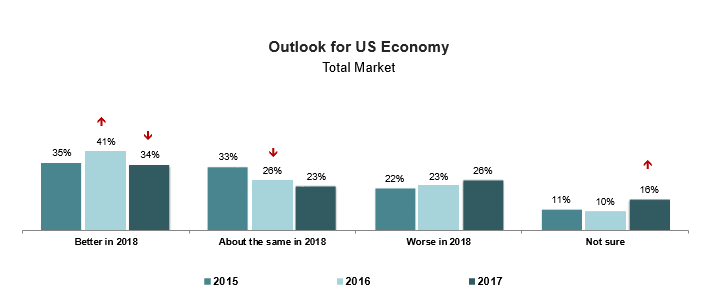

Despite all the bright spots, Americans, in general, appear less optimistic about the US economy in 2018:

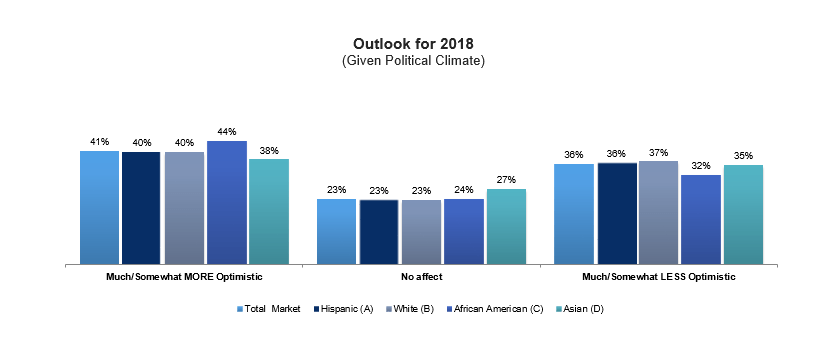

A combined 40% are either unsure or feel it will worsen. However, a clearer picture emerges when we ask what effect the current political climate has on personal outlooks for 2018:

Given the current political climate, nearly as many people are pessimistic about 2018 as they are optimistic. This polarization in outlook mimics the current political polarization we find ourselves in and gives more context to the dip in optimism for 2018 and consumers’ unwillingness to make large purchases in 2018.

Furthermore, as our research and Census research has shown, we are coming off a record year for rising incomes. Consumers naturally feel less optimistic, financially, after a particularly good year. But consumers still have concerns about financial markets, which could impact their future ability to spend down the road hence causing unease.

Key Takeaways

While consumers, in general, are divided on the outlook of the economy, there are bright spots for brands looking to tap into multicultural markets with thoughtful campaigns that are sensitive to the real areas of concerns these consumers are feeling. Hispanic and African-American consumers experienced an increase in incomes in 2017 and are looking to spend, but African-Americans are also the least optimistic about the economy improving in 2018. The brand that strikes the right balance will make the biggest impact.

Download our detailed report here: