ThinkNow Smart Fitness: The Rise of Connected Fitness and Community

The pandemic has accelerated the shift from traditional in-person gym memberships to broader acceptance of at-home connected fitness equipment. But a recent ThinkNow study shows that the gym isn’t dead, and connected fitness has a long way to go.

For our 2021 ThinkNow Smart Fitness Report, ThinkNow conducted a nationwide online survey of American adults ages 18 to 64 to understand consumer usage of internet-connected fitness equipment and perceptions of connected fitness brands. Download the report here.

Room To Grow

Twenty-five percent of respondents report owning connected fitness equipment. Ownership is highest among Non-Hispanic Whites and African Americans. Within the Total Market, ownership is highest among Millennials and increases drastically with income, and men are twice as likely as women to own smart exercise equipment.

It’s important to reiterate that only one out of four respondents report owning connected fitness equipment, and 20% of those who do not currently own it are at least somewhat interested in purchasing it. This data suggests a tremendous opportunity for brands innovating in or entering the connected fitness space.

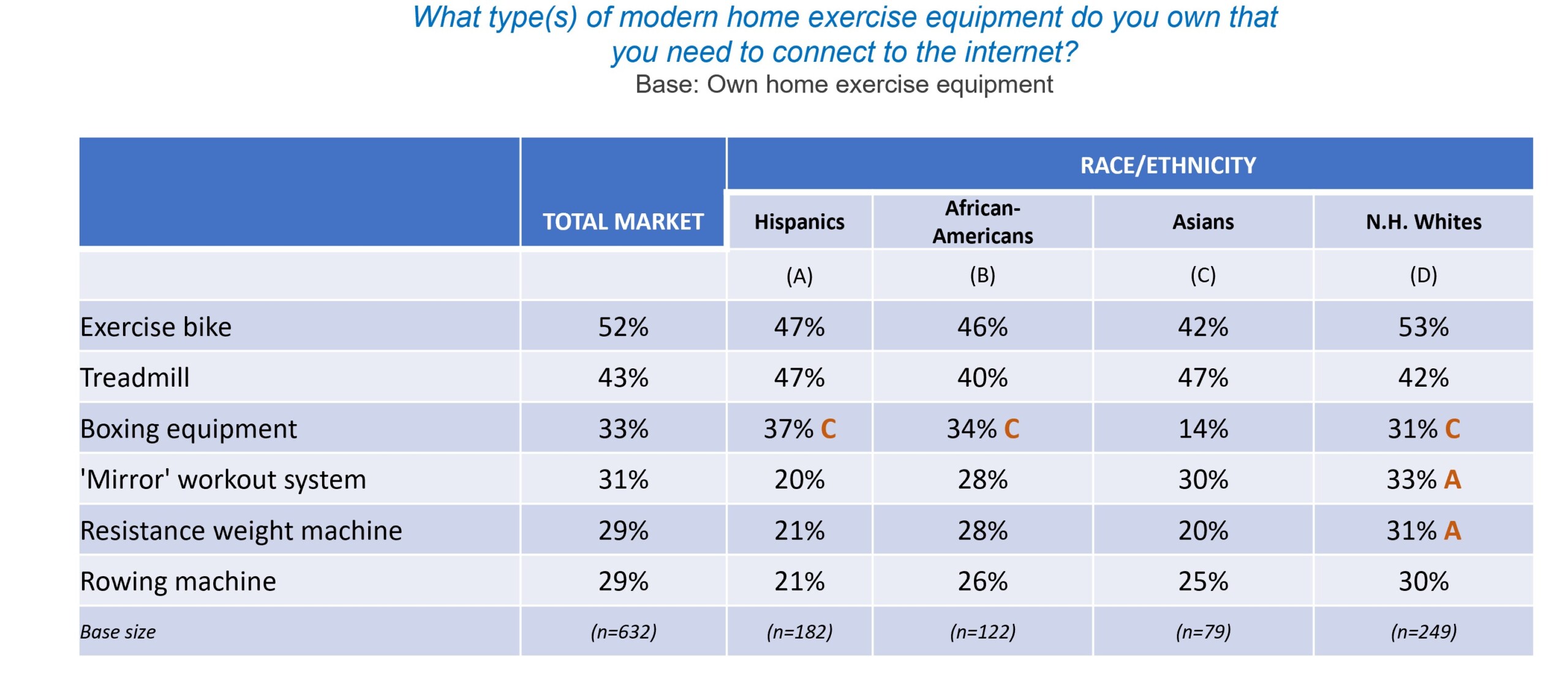

Most Popular Connected Fitness Equipment

However, differences emerge when we take a closer look at the types of connected fitness equipment consumers own. Exercise bikes and treadmills, artifacts of the 1970s and 80s fitness movement, have maintained their appeal over the years, getting “smarter” with each passing year. Traditional resistance weight machines, reminiscent of the bodybuilding craze, appear to be losing some ground to, more minimalistic forms of strength training, like resistance bands.

Interactive training workouts like the Mirror are starting to gain traction, especially among affluent, male, Non-Hispanic White consumers ages 39-54. But lowest among Hispanics.

Of the most popular brands of connected fitness equipment available, Peloton, Mirror, and NordicTrack are favored by respondents, while CLMBR, Tonal, and SoulCycle, rank in the bottom few. However, competition within this space is heated, with only a slim margin separating one brand from the next, especially as lines start to blur on product offerings.

Mirror, for example, offers a variety of workouts, from cardio and strength training to Pilates and Tai Chi. Accessories include fitness bands and yoga blocks but no weights. They likely pride themselves on their minimal impact on home life. Tempo and Tonal, however, both positioning themselves as “smart gyms,” offers accessories like weights and smart handles to maximize workouts. NordicTrack has a suite of products, including exercise bikes and an interactive “mirror” similar to Tempo, with a vault of weights and accessories inside. And while Peloton is probably more known for its bikes, the company also offers boot camp style workouts, yoga, barre, among others, with no equipment required.

The most significant threat to the success and continued adoption of connected fitness equipment is forward-thinking gyms innovating to stay competitive.

The Future of Fitness Is Hybrid

As COVID restrictions expire, we can expect gyms to resume normal operations at full capacity. However, the post-pandemic gym experience will need to look and feel different than it did pre-pandemic. Consumers have become more health aware. There is a focus on physical and mental health and the natural benefits of a more active lifestyle. So, consumers are looking to fill their portfolio of fitness options, which may include both in-person gym and home-based connected fitness experiences.

The reality is, not all consumers are ready to integrate back into the gym fully. Some people are still working from home, making connected fitness more appealing. While others see the gym as a welcome respite from the monotony of working from home all day.

Fitness brands and gyms must avoid siloing consumers, however. Most industries, including fitness, will be increasingly dependent on technology in the future. So, gyms will need to modernize to stay relevant while messaging the benefits of brick-and-mortar workouts, like guaranteed “me time,” a claim connected fitness brands can’t make because the equipment is likely located in a shared space within consumers’ homes. However, connected brands can tout the ability to work out from anywhere via a mobile app and get the same access to high-profile trainers at home or on the go.

Ultimately, both gyms and connected fitness brands need to lean into the one advantage they both share – community. Working out alongside your fitness-minded peers is empowering and energizing, be it in-person in a group fitness class or virtually. Connected fitness users can engage with one another in numerous ways, depending on the equipment. Mirror, for example, encourages users to enable the community cameras, and Peloton recommends its Leaderboard, Here Now, and Video Chat features. Modern fitness has evolved into a shared experience best served by a hybrid model giving consumers the flexibility to choose how and when they workout while building a supportive community to cheer them on.