ThinkNow Retail™ : Retailers May Be In For A Surprise This Holiday Shopping Season

Now in its sixth year, one of our most popular reports, ThinkNow Retail™, has just been released, chock full of multicultural insights that give us some visibility into what retailers can expect during the 2018 holiday shopping season. The insights reinforce some trends we’ve seen the past several years such as the steady rise of online and mobile shopping. But, the report also has some surprises like Walmart dethroning Amazon as the number one destination for holiday shoppers.To download the full report, click here.

Let’s take a closer look at some of the highlights from the 2018 ThinkNow Retail™ report.

Timing Is Everything

Holiday marketing seems to start earlier every year, right? Consumers tend to think that’s driven by corporate marketers looking to extend their holiday sales season, but when we look at the data, consumers, in general, are driving the trend.

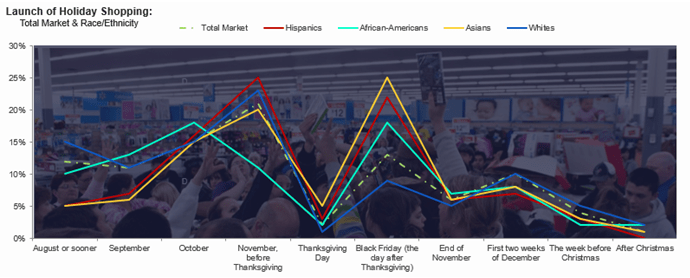

Close to one-fourth of holiday shoppers will begin their holiday shopping before October. The most popular month to start is November.

The reason for this boils down to a few things. For many shoppers, getting holiday shopping done early outweighs the savings offered during the holiday rush. If you take a close look at the data on Slide 8 of the report, you’ll see the highest percentage of early shoppers fall within that 35-54 age range. Here, you may have more shoppers with families/kids who take advantage of school hours to get that shopping done. Around the holidays, kids are out on break and are more underfoot which complicates matters. Families shopping for children also start early to avoid stock outs on popular toys (think American Girl) which can help avoid "Jingle All the Way" movie moments. Conversely, the lowest percentage of early shoppers fall within that 18-34 age range which suggests that younger shoppers with less disposable income will wait for the deeper discounts offered in November.

When we look at this data by race/ethnicity, we see the peak shopping periods are in November -- before Thanksgiving and Black Friday. Hispanic and Asian shoppers get a later start than White and African-American shoppers, which may be evidence of cultural influences.

Marketing Implications: While cultural nuance is the crux of effective multicultural marketing, the timing of your holiday campaigns can be powerful as well. For example, understanding when Hispanic consumers are most likely to shop vs. African-American consumers impacts the timing of your digital ad spend and potential ROI. A deeper understanding of cultural nuance, alongside timing, is essential to the multicultural marketing mix this holiday season.

Holiday Spending Expected to Decrease

While many key economic indicators of the U.S. economy are positive, this does not seem to be extending to consumers this holiday season.

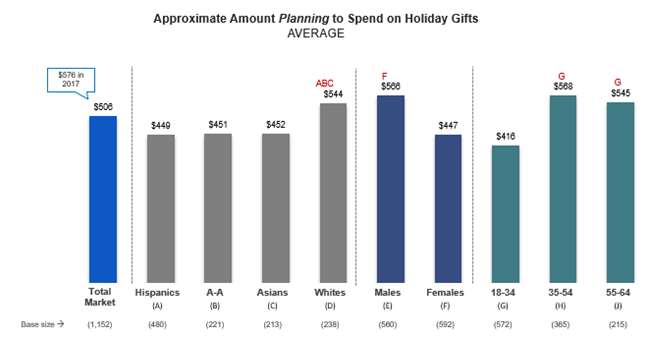

Overall, consumers plan to spend an average of $506 on gifts this holiday season. This is $70 less than last year’s average.

Looking at ethnic/racial cohorts, we see non-Hispanic whites planning to spend the most overall this holiday season at $544. GenXers top the generational cohort spending pack planning to spend $568 this holiday season. This is statistically significantly more than Millennials who plan to spend just $416.

Given the current social climate, the numbers make sense and serve as a barometer for consumer sentiment in the country. Minority consumers are pulling back on spending. GenXers, seeing a few more dollars due to the health of the economy, feel more comfortable splurging a little.

Marketing Implications: A significant amount of marketing energy has been directed towards Millennials and now GenZ the past five years. However, seeing as though spending is down overall and especially among those two groups, focusing on GenX and Boomers this season may be a safer bet. With plans to spend significantly more money this holiday season, targeting GenX and Boomers may be the antidote to a potentially sluggish holiday season.

Through the Looking Glass

The term “window shopping” may need a little dressing up for the 21st century. While consumers are peering through the glass to browse for gift ideas, it’s not the window glass of a storefront, but rather the glass of our mobile phones and laptops.

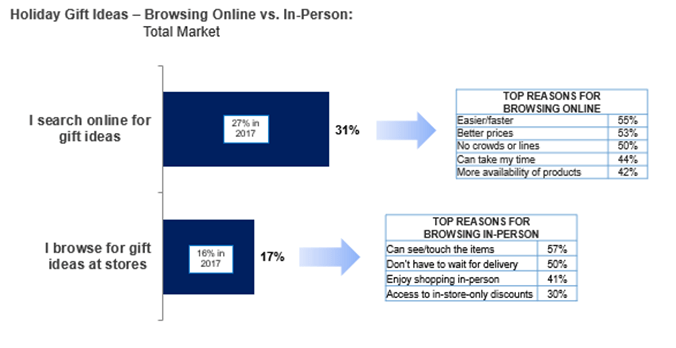

Shoppers are more likely to browse for gift ideas online than in-person.

Thirty-one percent of consumers are searching for their holiday gifts online this year representing a 4-point increase over 2017. The same trend is seen across age, gender and race/ethnicity. Consumers prefer browsing online because they feel it is faster, prices are better, and they avoid the holiday crowds and long lines.

Marketing Implication: Omnichannel marketing is no longer a nice to have, it is a must. Consumers are searching for everything online and buying wherever it is more convenient– mobile, online, or brick and mortar. This trend is showing no signs of slowing, as browsing online surpasses in-person. Develop an omnichannel strategy to deliver the seamless experience consumers expect.

Battle of The Giants

Amazon and Walmart have been battling it out this year. From Walmart investing more in its online shopping infrastructure to Amazon continuing to invest in its brick and mortar expansion, the two retail giants are battling it out. The holiday season is the ultimate bout of the year for these two retailers and consumers are the victors.

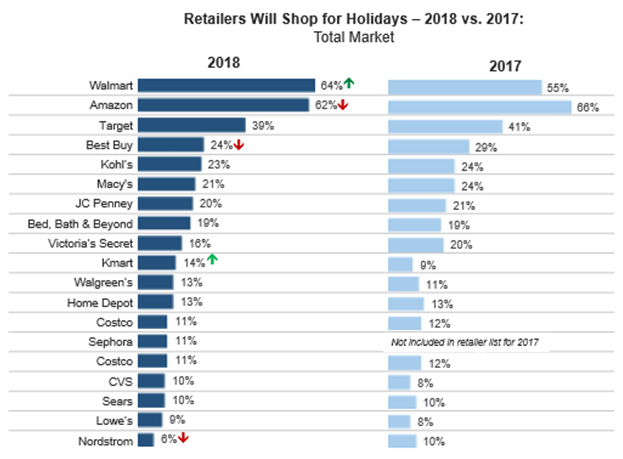

Amazon and Walmart are the top two retail destinations for holiday shoppers this season.

Walmart, although by a small margin, topped Amazon this year, pulling ahead as the top retail destination for holiday shoppers this season. More consumers said they will shop at Walmart and Kmart this holiday season compared to one year ago. The close of Toys “R” Us may be a contributing factor to this. A few retailers were mentioned less often this year, including Amazon and Best Buy.

Marketing Implication: It is easy for marketers to think that Amazon should be the only retailer they should be focusing on from a marketing perspective. The reality is that not only is Walmart dominating the brick and mortar dollars, but their investment in mobile and online infrastructure is paying off. Walmart should be top of mind for marketers as they continue to win consumers back.

Online and In-Person Sales Are Neck and Neck

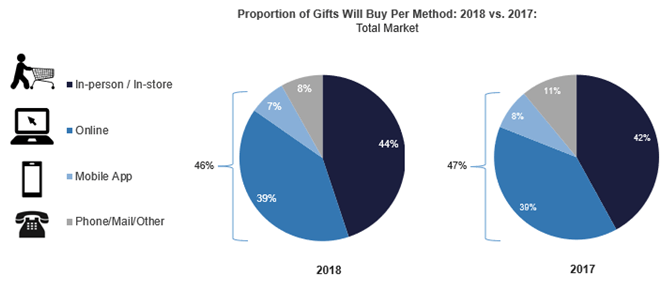

While consumers are significantly more likely to browse for gifts online vs. in-person, when it comes to purchasing their holiday gifts, our report shows a different story.

Shoppers are as likely to buy their gifts online or via mobile app as they are to buy in-person. Most online shoppers make purchases through their smartphone.

In-person / In-store shopping is still a key part of the holiday shopping journey as it is still relatively on par with online/mobile app shopping. However, as we break out the results by ethnic/racial groups, we see that African-Americans, Asians, and Whites are more likely to shop online/via their mobile phones. But Hispanics, are most likely to buy gifts in person. This, again, goes back to cultural influence. Hispanics, in general, see shopping as a family affair and want to share that experience together. While Hispanics typically over-index on digital use, this is one instance where they prefer to stay off the grid.

Marketing Implication: In-person shopping continues to thrive. While consumers are browsing online and purchasing in-store, investing in retail advertisements can sway last-minute shoppers. Conversely, groups such as African-Americans and Asians who are more likely to shop online or via their mobile phones can be specifically targeted through digital campaigns that capitalize on their propensity for online shopping.

| ThinkNow ConneKt Insight: Mobile gaming advertising is an effective way to reach mobile heavy consumers. Looking at African-American consumers, specifically, consider investing marketing dollars in puzzle and action games as 62% of African-American mobile gamers play puzzle games and 53% of African-American mobile gamers play action games. |

The Holidays Don’t End on New Year’s

While it feels like the holiday shopping season is starting earlier and earlier every year, for some Hispanics, the holiday season really does extend beyond December and into the first week of January.

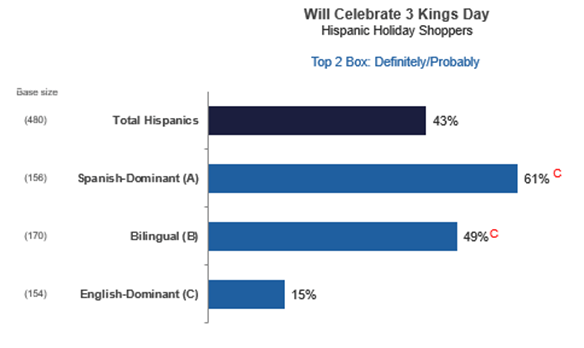

4-in-10 Hispanic shoppers will celebrate Three King’s Day.

This share is even higher among Spanish-Dominant and Bilingual Hispanics at 61% and 49& respectively as they use the holiday as a means of staying connected to the heritage of their native countries.

Marketing Implication: 3 Kings Day is a unique opportunity to reach Latinos during the holiday season, especially Spanish-dominant and bilingual Latinos. Not many brands utilize 3 Kings Day as a marketing opportunity because it doesn’t appeal to the mainstream. But, those marketing mavericks who take the chance have an opportunity to tap into an underserved market while demonstrating cultural sensitivity.