Online Consumer Research – Online vs. Offline Research

At ThinkNow Research we are proponents of conducting Hispanic consumer research online among all acculturation levels. There are, however, some caveats that need to be understood when choosing a research methodology. Gone are the days when one could use a landline and achieve a representative sample of a target population. As landline penetration rates have fallen, cell phone and internet penetration have increased but have complicated the research landscape in the process.

There currently is no one methodology that solves all research needs. When we put together an online sample of Hispanic survey respondents we strive to replicate the characteristics of the population at-large, not of online survey takers. This necessitates some careful upfront planning often using Census population figures as a guide. When care is taken in the sample design the end results are often very similar for online and phone results. Unfortunately, there can be some differences that arise from the methodology that need careful attention.

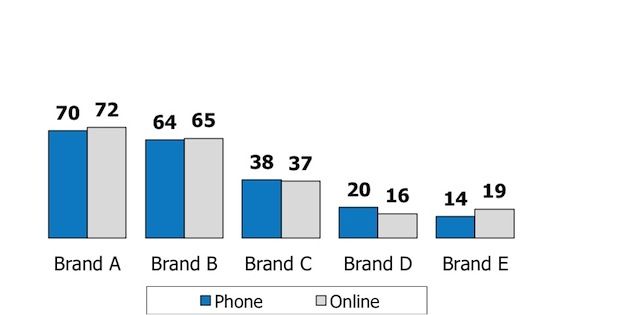

We’ve found that awareness of and purchase rates for high-use, low-cost items are quite similar for online and offline samples as in this example from a recent mixed-mode study:

Which of the following brands of bread have you ever heard of? (Hispanic brands)

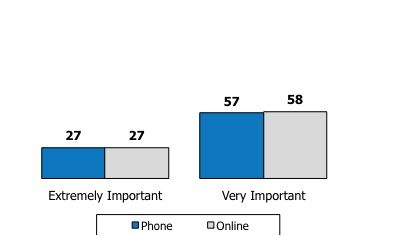

We have also see very similar results for claimed behaviors or interests among Hispanics that that are not necessarily tied to socio-economic factors such as in this question:

How important is it to you that your children and grandchildren are able to speak Spanish?

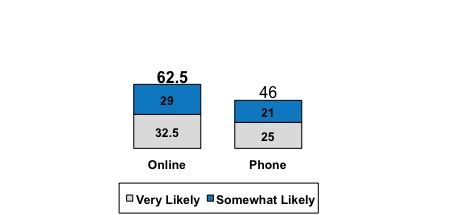

However, purchase rates for high cost, low purchase frequency items such as automobiles and high-ticket home appliances/electronics show distinct differences depending on the methodology used. Fortunately, we have found that the relationship between responses within scales remains constant as in this example:

Purchase Intent Comparison

In this case, purchase intent measures higher for online respondents but the relationship between the top 2 boxes remains consistent. This constancy is reassuring but the overall difference in the responses needs to be addressed. This is where mixed-mode can help. If for example, we’re doing research in an area that we suspect will yield different results based on methodology we often will conduct the base survey online and add phone and/or intercept completes to the sample to help iron out the methodological bias as well as pull in a more representative sample of respondents.

Fortunately for consumer packaged goods, there are minimal differences in online and phone responses among Hispanic respondents and an all-online methodology can often be used. Special attention, however, must be focused on the sample and survey design to account for differences among Hispanic acculturation groups and how they respond to survey questions.

We will delve into these differences on our next article.