Legal

Financial Services Industry Strives to Navigate U.S. Latino 'Bothism'

Marketers often fall into the trap of binary thinking, hindering creativity and clashing with consumers seeking fluidity. While the industry has struggled to embrace bothism – the concept of merging seemingly opposing approaches for better results – multicultural consumers in the U.S., particularly bi-cultural Latinos, have fully adopted it. Many see themselves as American and Latino, not half and half, but 200%, wholly embracing their American and Latino identities.

Honing in on the financial services sector, let’s explore cultural bothism among bi-cultural Latinos through the lens of language, age, and income to gain insights that can inform financial institutions' strategies to engage this diverse consumer group effectively.

Language: Spanish vs. English

When discussing how to reach Latinos, language tends to be the most polarizing topic. Traditional Spanish-language media portrays all Latinos as Spanish speakers, while newer media platforms targeting younger Latinos suggest otherwise. However, recent Pew Research data reveals a nuanced reality: 75% of all Latinos can proficiently converse in Spanish. Yet, this percentage varies significantly across generational cohorts, with second-generation Latinos at 69% and third-generation Latinos at 34%. Considering the youthfulness of the Latino population, with 25.7% of U.S. children being of Hispanic origin, 32% of Hispanics being under 18 and 26% being Millennials, it's evident that targeting specific generational segments is crucial. For financial products, the language strategy should be tailored accordingly:

For immigrants, Spanish remains a safe bet. For Gen Alpha and younger Millennials, English is preferable. For older Millennials and Gen X, Spanglish can be effective when used authentically, as research indicates its power.

Age: Older vs. Younger Latinos

Marketers often highlight the youthfulness of the Latino population, with the median age at 30 compared to 41.1 for non-Hispanics. However, this demographic is also rapidly aging, with the number of Hispanic adults aged 65 and older nearly tripling since 2000 and projected to quadruple by 2060. This dual demographic reality presents unique challenges and opportunities, especially in financial services.

Caregiving in particular is a significant concern, as Latino caregivers face financial strain while balancing work and caregiving responsibilities for both children and elderly family members. Financial institutions can address these needs through resources like multigenerational retirement planning workshops, multilingual financial education materials, customized financial products, the promotion of government assistance programs, and the provision of culturally sensitive advisors.

Income: High income vs. Low Income Latinos

In addition to language and age, income must be considered. Hispanic households had a median net worth of $52,190 in 2020, significantly lower than the $195,600 median for non-Hispanic households. Despite economic challenges, many Latinos still view the U.S. as offering more opportunities and better healthcare access than their countries of origin. Our research, the Millennial project, found that over 71% of Millennial Latinos believe in the American dream, compared to 55% of non-Latino Millennials.

Homeownership represents a cornerstone of the American dream for many Latinos. In 2023, the Hispanic homeownership rate reached 49.5%, with a net gain of 377,000 owner-households. While facing barriers like rising interest rates and low inventory, Latino homebuyers remain resilient, utilizing co-borrowers and specialized programs to achieve homeownership.

Financial institutions can assist Hispanic homebuyer hopefuls through accessible homeownership programs, community outreach and education, multigenerational financial planning, cultural competency training for staff and accessible financial resources.

Navigating Latino bothism in financial services goes beyond the scope of these three examples, yet they serve as a framework for fostering genuine connections with Latinos. Marketers within the financial sector must transcend binary thinking and embrace the nuanced duality within this diverse consumer base, understanding how factors like language, age, and income shape their perspectives. By doing so, financial institutions can effectively tailor their strategies to meet Latino consumers’ needs and build meaningful relationships that drive long-term success.

This blog post was originally published on MediaPost.

we demistify diverse communities through research technology

Legal

Suma Wealth: Empowering Financial Inclusion Among Latinos with Insight and Humor

The evolution of financial technology, commonly referred to as 'fintech,' has undergone a remarkable surge in recent years, empowering consumers to conduct their banking activities on their terms from any location. So high is the demand for online financial tools that banks like Bank of America, which started shuttering its drive-through teller lanes in 2013 due to low usage, have pivoted to establish robust digital solutions. These solutions are tailored to help consumers manage their personal finances exclusively through online channels. This shift is not limited to central banks, however. Online banks like Ally Bank and neobanks like Chime are also vying for consumers' attention, offering both traditional and non-traditional banking services and greater flexibility than their brick-and-mortar counterparts.

Among the consumers embracing fintech are Latinos, who do so at a higher rate than other demographic groups. This trend can be attributed to a few factors. The Latino population in the U.S. skews younger, and as younger consumers are generally more predisposed to adopting new technologies, fintech becomes a natural choice. Additionally, Latinos may face language barriers and systemic challenges such as discrimination, making fintech options more attractive and accessible.

Regardless of how consumers choose to bank, most agree that understanding and managing one’s finances is essential to building wealth and economic self-sufficiency. For Gen Z, especially those subscribing to the concept of 200%, where individuals embrace their dual identity as both American and Latino and whose motivations for wealth-building differ from their parents and grandparents, using an in-culture digital-first financial platform to demystify complex financial concepts is key to engaging them.

In this episode of The New Mainstream podcast, Beatriz Acevedo, CEO and Founder of Suma Wealth, underscores the importance of developing culturally relevant fintech tools to increase financial literacy in the Hispanic community. To download the SUMA App, click here.

we demistify diverse communities through research technology

Legal

How Fintech is Changing the Way Gen Z Manages Money

Americans are feeling the pinch in their wallets, with fears of a government shutdown looming and prices for everyday goods and services rising. Consumers have been on an economic roller coaster for a few years due to COVID-19, which left millions jobless, and George Floyd's murder, which sparked national protests for social justice. These events have caused a ripple effect throughout the economy, leaving many people struggling to make ends meet.

During the COVID-19 pandemic, many consumers went from overspending to spending far less as household incomes fluctuated. Those who could afford to spend increased their e-commerce purchases and invested in new financial instruments like cryptocurrencies. However, with the continuing economic uncertainty, consumers are generally being more cautious with their spending.

Generationally, Gen Z consumers aged 16 to 25 have proven resourceful when it comes to personal finance, particularly “Zennials” (also known as “Zillennials”), older Gen Z and younger Millennial consumers on the fringes of their cohorts. But unlike Millennials, who as a generation are struggling to catch up to where they should be from a savings perspective due to factors like student loan debt and pandemic losses, have struggled to plan. But their younger siblings, Gen Z, have watched and learned, leaning into advice from family and friends on what to invest in and leveraging fintech tools to manage their money.

Fintech is addressing the gaps in financial planning by meeting consumers where they are – online. Thus, the rise of fintech apps enabling consumers to forgo traditional banking models and embrace digital tools to handle money matters. This has become particularly important to underserved consumers who experience banking differently.

Younger generations are open to using AI-based tools for money management, but they still value human input from parents and financial advisors.

In this episode of The New Mainstream podcast, Lilah Raynor, CEO of Logica Research, explores the money management habits of Gen Z and Millennials and sheds light on AI's impact on financial services.

we demistify diverse communities through research technology

Legal

Black Consumer Project Wave 2: Exploring Black Americans' Relationship With Financial Services

For decades, research has painted a picture of a Black America that is distrustful of the financial system, hesitant to adopt banking services, and resistant to guidance. While economic disparities and trust deficits exist, banking habits in the Black community are incredibly diverse. In this latest chapter of the Black Consumer Project, we look at how Black Americans manage money today.

What is the Black Consumer Project?

A collaborative effort by ThinkNow and Quantasy + Associates, Black Consumer Project is an in-depth, multi-wave study of Black Americans' economic and cultural contributions. This community has more buying power than ever, and our goal is to uncover its unique perspectives, behaviors, and preferences.

Wave 1 of BCP explored Black Americans' core values, personal goals, layers of identity, and definitions of success. Wave 2 takes a deep dive into their banking behaviors, financial perceptions, and aspirations for the future.

Stream the Black Consumer Project - Financial Services online event here.

Increasing Influence

According to the 2020 Census, the Black population has increased by 5.6% over the past decade. Those who identify as Black in combination with another race group increased by 88.7%. The median household income (HHI) for Black Americans was $44,000 in 2019, meaning that just under half of all households (46%) earned more than $50,000 a year. Those earning more than $100,000 represent 18% of the overall Black population. Education has also increased significantly, with the population of those with a bachelor's degree (23%) doubling since 2010. With a population of 46.9 million, Black Americans wield an impressive $1.4 trillion in buying power.

Motivating Factors

During the first wave, we discovered that Black Americans' definition of success isn't tied to money. Living a healthy lifestyle, owning a business, and giving back to the community ranked higher when compared to non-Black ethnic groups. In this second wave, we explore the relationship between the Black community and finance to better understand current behaviors and aspirations for their financial futures.

See the Data

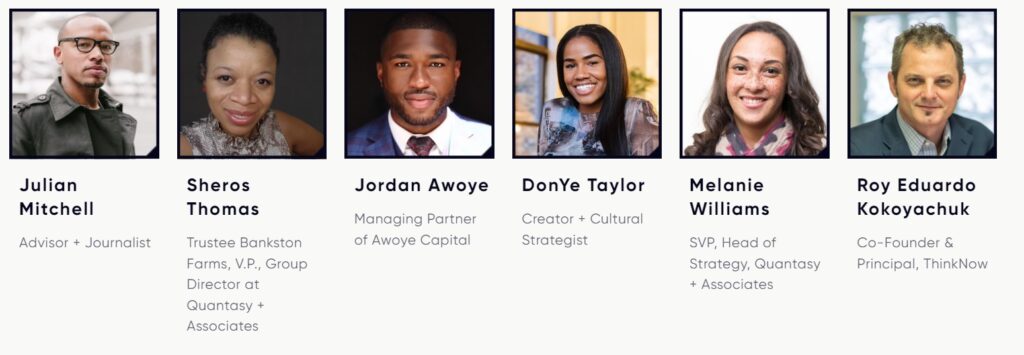

The Black Consumer Project Wave 2 launches Tuesday, July 12th with an online streaming event featuring Quantasy + Associates' Melanie Williams and ThinkNow's Roy Eduardo Kokoyachuk, who'll dive into the data. A panel discussion featuring Jordan Awoye, Managing Partner of Awoye Capital, DonYe Taylor, Creator and Cultural Strategist, and Sheros Thomas, Trustee Bankston Farms, V.P., Group Director at Quantasy + Associates, will follow moderated by Julian Mitchell, Advisor and Journalist.

Stream the Black Consumer Project Wave 2 – Financial Services here.